In the underground world of carding, not all credit card numbers are created equal. Some are low-limit debit cards that get flagged fast. Others are platinum-level, high-limit cards that slide smoothly through Apple Pay with almost zero resistance. The difference? Knowing how to use BIN lists strategically.

This post will break down how experienced fraudsters (and cybersecurity researchers studying them) use BINs to filter for high-limit cards, bypass restrictions, and maximize Apple Pay fraud. Let’s dive in.

What Is a BIN List?

A BIN (Bank Identification Number) is the first 6 to 8 digits of a credit or debit card number. These digits identify the issuing bank, card type (e.g., Visa, Mastercard), card level (Classic, Gold, Platinum), country, and even whether the card is prepaid, debit, or credit.

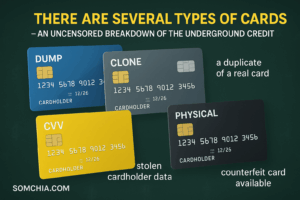

A BIN list is simply a database that maps these digits to card details. Carders use BIN lists to filter stolen card data — commonly known as dumps, CVVs, or fullz — for cards with the highest fraud potential.

Want to check a BIN yourself? Try public tools like BinDB or BinList.net.

Why Apple Pay Fraud? And Why BIN Lists Matter

Apple Pay is a carder’s playground — no CVV required, fast contactless payments, and fewer verification layers when set up on jailbroken iPhones or through manipulated provisioning.

But here’s the catch: not every card works.

To successfully link a stolen card to Apple Pay, you want:

-

High-limit cards

-

Credit, not debit

-

Non-prepaid

-

Issuer banks that are Apple Pay-friendly

-

Clean cards that haven’t been flagged

This is where BIN filtering comes in. You can waste hours testing random cards — or you can use a BIN list to laser-focus on cards that are statistically proven to work.

️ How I Filter for High-Limit Cards Using BINs

Here’s a step-by-step breakdown of how seasoned carders or threat analysts approach BIN filtering:

1. Get a Fresh Dump or Fullz List

Start with a fresh list of stolen card data. This can be bought from CC shops or private telegram channels dealing in dumps + PIN or CVV2 + fullz.

Examples of popular search terms:

-

buy cc dumps

-

cvv dumps shop

-

dumps and fullz

⚠️ Many of these are honeypots or scams. Researchers often use them to track carding activity.

2. Run the BINs Through a Checker

Use a tool like:

-

Python scripts using free APIs from BIN Lookup

You’re looking for:

-

Card level: World Elite, Platinum, Signature Preferred

-

Card type: Credit (not debit)

-

Bank: Avoid regional banks or prepaid issuers

-

Country: US, UK, Canada preferred (fewer friction points with Apple Pay)

Example BIN filter results:

| BIN | Card Type | Level | Bank | Country | Use? |

|---|---|---|---|---|---|

| 414720 | VISA | Platinum | Chase | US | ✅ |

| 530071 | MasterCard | World Elite | Citi | US | ✅ |

| 402400 | VISA | Prepaid | Green Dot | US | ❌ |

3. Sort for High-Limit Issuers

Certain banks are known for issuing high-limit cards. Here are a few “carder favorites”:

-

Chase Sapphire Preferred/Reserve

-

American Express Platinum/Gold

-

Capital One Venture

-

Bank of America Cash Rewards (credit, not debit)

Look for these keywords in BIN databases or fullz listings.

4. Check for Apple Pay Compatibility

Some banks do not allow Apple Pay provisioning from unknown IPs, while others are lax.

A few that are known (among underground communities) to work well with Apple Pay:

-

Citi

-

Capital One

-

American Express

-

Barclays

-

Synchrony

Cross-reference your BIN results with these banks for better success.

5. Run Apple Pay Setup on Virtual Machines or Emulators

Advanced fraudsters simulate a clean Apple environment to run provisioning scripts, or they use:

-

Jailbroken iPhones

-

Xcode Simulators + VPN

-

Emulated NFC payment terminals for testing

All of this is powered by the BIN-filtered high-limit cards, increasing approval rate and decreasing traceability.

⚠️ Ethical & Legal Notice

This blog post is intended for educational and cybersecurity research purposes only. Credit card fraud is a serious crime. Law enforcement actively monitors many of the sites and marketplaces mentioned in carding circles.

If you’re in cybersecurity or fraud prevention, understanding these tactics helps protect consumers and harden systems against this evolving threat.

♂️ Read more from experts: FBI IC3 on Carding Trends

️ Visa’s Anti-Fraud Guide: Visa Security Roadmap

Final Thoughts

In the fraud economy, BIN lists are the key to unlocking high-value targets. Whether you’re looking to detect fraud attempts or understand how underground operators optimize Apple Pay setups, knowing how BINs are filtered is essential.

The next evolution in carding isn’t about quantity — it’s about quality. And it all starts with the right BIN.