The financial system loves to make you feel small. They hand you a shiny piece of plastic and act like they’re doing you a favor. But if you’ve been around long enough—on the surface or buried deep in the networks where firewalls meet shadows—you’ll learn one fundamental truth: cards are weapons. Every digit, every magnetic strip, every bin code is a key. And when you know what doors they open, the system starts to look a whole lot more penetrable.

Let me cut the fluff and drop what the banks don’t want you to think about: not all cards are created equal. They may look the same in your wallet, but under the hood, it’s a hierarchy of control, privilege, access—and potential for exploitation.

Cracking the Classification Code

Cards fall into categories not just by brand (Visa, MasterCard, Amex, Discover) but by what they unlock, how traceable they are, how they’re enrolled, and who the issuing bank is. The issuer matters. A Chase Sapphire Reserve backed by JPMorgan is built like a fortress; a random regional bank’s Visa Debit? More like a convenience store with a broken security camera.

That’s why if you’re doing real recon—dark web recon, elite ops level, not some beginner Telegram plug BS—you don’t just look at the card. You dissect it.

Here’s a snapshot of how the underground classifies and values these cards. Not by some random FICO score, but by liquid potential, resell value, and exploitation readiness.

Top U.S. Credit Cards – The Whales of the Game

Let’s talk raw credit lines. These are not your basic, Walmart-purchasing, Uber-subscription cards. These are launchpads for five-figure plays.

-

Chase Sapphire Reserve – $10,000 to $50,000+

-

Amex Gold & Platinum – No preset limit (but trust me, it ain’t unlimited unless you’ve got real profile power)

-

Capital One Venture – $5,000 to $30,000+

-

Bank of America Premium Rewards – $5,000 to $25,000+

-

Citi AAdvantage Executive – $25,000 to $75,000+

Now these cards? They’re the gold mines. Why? Because they’re connected to high-credit individuals, low utilization, and responsive customer service—all essential when you’re flipping, enrolling, or draining.

Elite & Ultra-Exclusive: Where Only Ghosts Walk

This is where the black cards come in. We’re talking invitation-only, $50K+ limits, and private banking strings attached. Cards like:

-

Amex Centurion – The infamous “Black Card.” Infinite potential but don’t even try unless you’ve got the fullz of a hedge fund exec.

-

UBS Visa Infinite – $100,000+ limits. Swiss banking level stealth.

-

J.P. Morgan Reserve – Issued to Chase’s private clients. Think $10M net worth types.

These aren’t just tools. They’re trophies—and once you get your hands on one, you’re no longer playing the game, you’re running it.

Debit Cards: The Stealth Bombers

Debit cards often get overlooked in the chatter. People think “limited funds, low value.” Wrong. The right debit card can be cleaner, quieter, and faster to work with—especially for enrollments.

Here’s your underground power list:

-

Goldman Sachs Marcus Debit

-

J.P. Morgan Private Client Debit

-

Charles Schwab Investor Debit

-

Morgan Stanley CashPlus

-

First Republic Bank Debit

These aren’t debit cards—they’re low-key attack vectors. Tie them to high-tier accounts, and you’ve got instant access to balances worth more than most people’s credit cards. The best part? They’re less suspicious during smaller, consistent transactions.

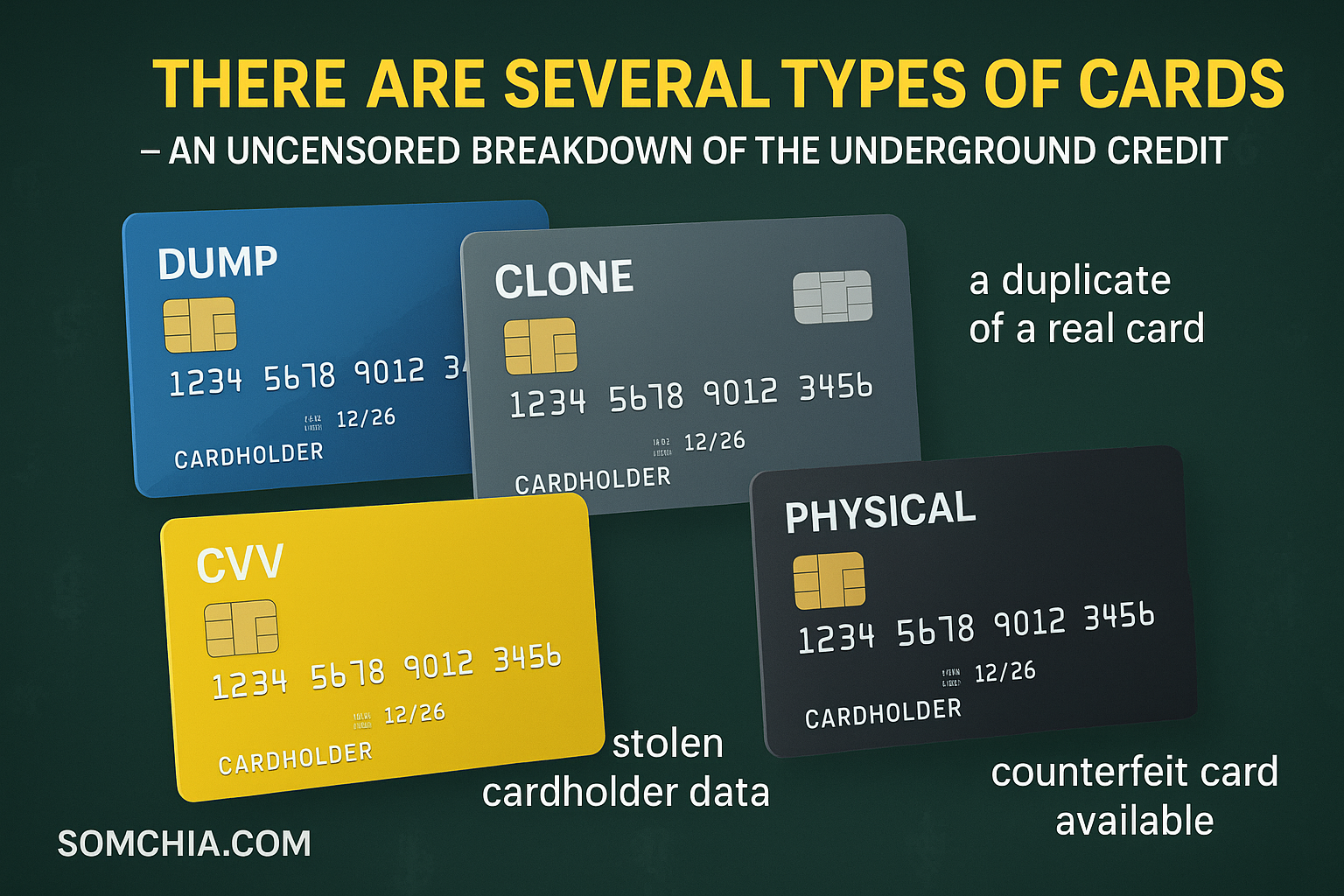

The Breakdown: Card Types by Playstyle

Let’s make it visual for the up-and-comers who still think “just buy a random CC and go.” Here’s how the community tiers cards:

1. Starter/Secured Cards ($200–$3,000 limits)

Think of these as training wheels. Useful for minor test runs or setting up low-risk enrolls.

-

Chime Credit Builder

-

Discover it Secured

-

OpenSky Secured

2. Unsecured Basics ($500–$3,000)

Mid-play usable, but don’t expect miracles.

-

Petal® 2 Visa

-

Credit One Platinum

-

Mission Lane Visa

3. Student & Store Cards ($500–$2,500)

Surprisingly good for Amazon, Target, and streaming-based methods.

-

Discover it® Student

-

Amazon Store Card

-

Walmart Rewards

4. Cashback/Rewards ($1,000–$10,000)

Sweet spot for most intermediate ops—used often in refund and cashback manipulation.

-

Wells Fargo Active Cash®

-

Citi Double Cash®

5. Gold/Premium ($2,500–$10,000)

Strong profiles, easy customer reps, and high trust ratings.

-

Amex Gold

-

Capital One Venture Rewards

6. Business & Travel Cards ($5,000–$50,000)

Great for invoice cashouts, merchant redirects, and corporate spoofing.

-

Amex Business Gold

-

Bank of America Business Advantage

The Real Game: Make or Buy?

Here’s the part no one tells you. The high-level guys don’t just buy cards. They make them. Either through synthetic ID work or by leveraging fullz into secure enrollments.

Sure, you can buy a card for 20% of the balance. That’s standard. But if you build it from the ground up—from SSN to DOB to DLN to email to account app—you control the narrative. You don’t hope it works. You know it will.

Some ops make $20,000+ off a single profile just by understanding how to shape a card from virtual dirt into financial gold.

BINs: The DNA of Every Card

BINs (Bank Identification Numbers) are the fingerprint. Want to know if a card is high-tier? You start with the BIN. Not just the first six digits anymore—real players study the full 8-digit scheme, compare it with active ranges, issuer banks, and behavior patterns.

As one seasoned operator said:

“Don’t ask where to find BIN lists. Create your own—trial and error is the only teacher that doesn’t lie.”

It’s not hard to do. Hook up a few test payments, cross-reference response codes, build out your map. That’s how you move from script kiddie to true threat actor.

The Final Word: Don’t Get Romantic—Get Strategic

Credit cards are not status symbols. They’re not financial tools. They are portals to manipulation, infiltration, and domination of a system that was rigged before you were born.

This game isn’t for the naive or the sloppy. It’s for the cold, calculated, and relentless. Learn the tiers. Build your lists. Test everything. And when you hold that $50K limit Amex tied to a clean profile you built from zero—you’ll know you’ve entered the upper echelon.

The cards are out there.

You just have to learn how to stack the deck.